Focus on what you do best,

myTalisman™ is for the rest.

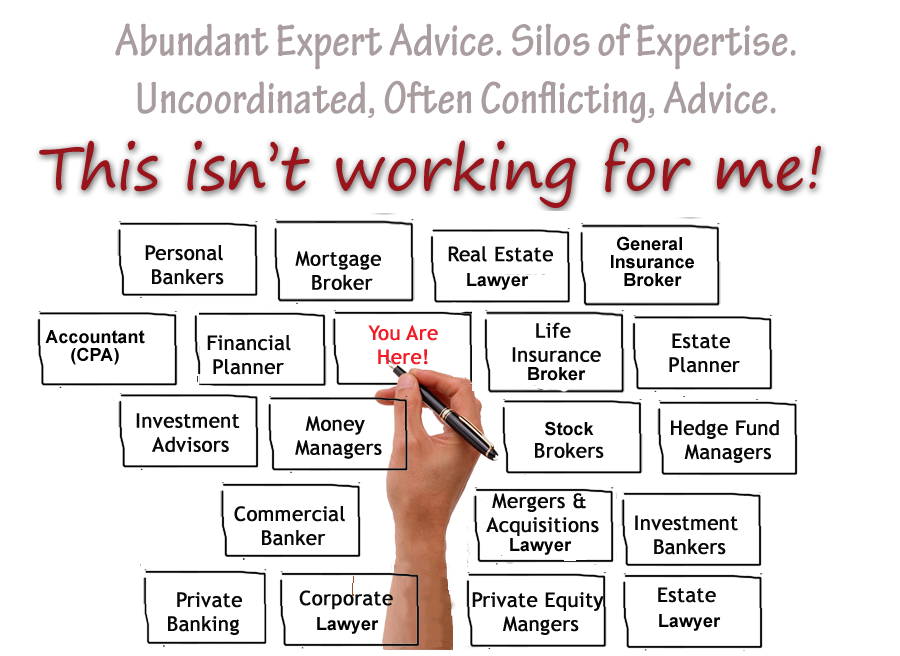

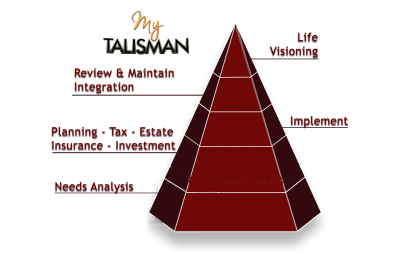

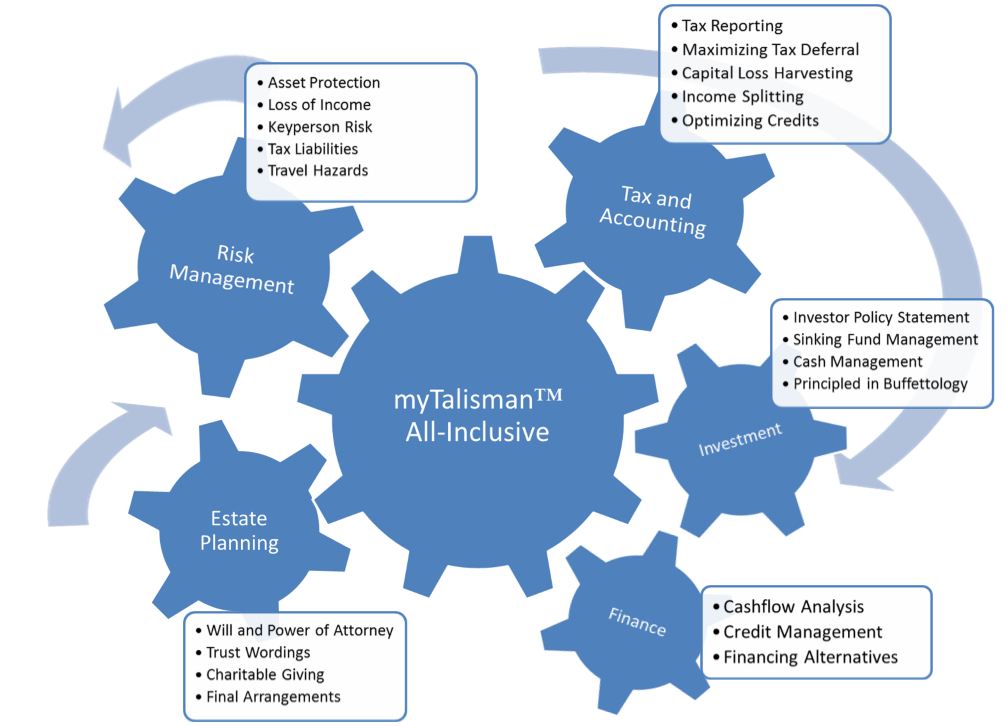

Excellence in personal financial management is what inspired myTalisman™. As you navigate through the changes in your life, myTalisman™ will adapt with you and ensure your key financial affairs remain in order. The beauty of myTalisman™ is that it is flexible enough to work with the people and resources you already have or with PEACE™, our alliance of professional advisors.

Good Fortune by Design

The purpose of myTalisman™ is to save you time and money by gathering, protecting, and uniting the people and things you care about. The process of delivery for myTalisman™ ensures that each individual financial component is addressed and/or integrated in the manner of your choosing. The benefit is greater confidence and peace of mind, good fortune by design.

Good fortune

is not left to chance

with myTalisman™

Process Details Summary

We are in the business of delivering high-end wealth management services to Canadians, including middle income families.

Our passion leads us to develop a framework of highly developed systems to democratize the process of wealth management. Our smarter systems of delivery and integration allow our clients to save their time and money while reaching their planning objectives more effectively and consistently.

The delivery is supported by customized technology solutions designed specifically to allow individuals to choose their level of engagement within the context of a fully unified service, similar to the family office experience enjoyed by those in the top 2% of income earners.

Following is a summary and a detailed explanation for the core functions we are providing.

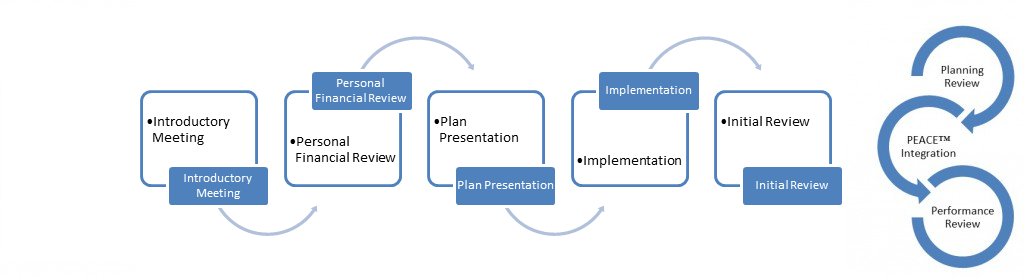

Introductory Meeting

During this first 20 minute meeting, we provide details about who we are, what we do, how we get paid, and we ask questions to determine whether or not there is a good fit for working together. Our client relationships are intended to be long term in nature and successful investing is intended to work the same way. The approach we use to achieve our client’s objectives is not for everybody, so we try to find out early on in the process if we may be wasting anyone’s time.

The introductory meeting is sort of like speed dating! In a relatively short period of time we can usually tell if the spark that brought us together is a short term feeling or something that will light us up for a long time to come. We offer a cooling off period of about a week and if we’re all still warming up to each other for the right reasons, we go forward together. Otherwise, if for some reason the chemistry isn’t right or, “one or the other isn’t feeling the love”, we’ll do our best to shine a light in the right direction and offer our best alternative before things go much further.

Personal Financial Review

The second meeting is more of a fact finding session than anything else. During the meeting we explain the Letter of Engagement which describes what to expect while working with each other. This is the meeting where we get to know you better than some of your best friends! We start by gathering information, for example, where you are in terms of your current age, when retirement is expected to happen, and how long you expect to live.

We learn about the cash flow that is coming in and going out and estimate how much will be needed later on, say during retirement, or for another objective such as educational funding or taking a sabbatical. There are variables that need to be determined for planning purposes, so we discuss what may be expected for investment returns and for inflation. We also consider current assets and liabilities, tax carry-forwards, insurance arrangements, and pension plans. We ask about succession planning, charitable giving and whether or not your Will and Power of Attorney are up to date. In short, we gather the information that is needed to really understand your financial situation and move toward a full understanding of who we’re dealing with. This meeting usually takes a couple of hours.

Plan Presentation Meeting

During the third meeting we summarize what was discussed in the previous meeting, and before we go much further, we’re asking for agreement on our Letter of Engagement and providing the schedule of services offered. Next we are presenting our Financial Planning Snapshot which is an outline of what we see happening for you financially, presented simply on a single sheet of paper. The Financial Planning Snapshot captures the time between now and your objective, your expected sources of income, your expected expenses, and the expected value of your savings at various points in time. We then present the same information under variable circumstances, again using a simple to follow and easy to understand format, with the intention of developing a complete understanding of the options for reaching your objectives.

Once we have general agreement on what it is that we’re looking at, then and only then will we suggest the most suitable course of action for moving you forward. In developing the plan it may be necessary to reach out and interact with your other professional advisors or to introduce you to others who may be able to assist you in areas which are beyond our level of competence. We have developed a preferred network of professional advisors, https://gotpeace.ca, who we feel are excellent resources and perfectly capable of assisting where needed. We review the Investor Policy Statement and discuss our approach to investing. If we’re in agreement with the approach and the proposals for moving forward, we continue toward implementation. At this point, we’ve met for another couple of hours and we’ve presented a personalized written financial plan.

Implementation Meeting

Initial Review

Planning Review

PEACE™ Integration

Performance Review

Performance review meetings include a comparison of overall investment performance against relevant benchmark indices. We articulate clearly the amount of money invested, its current value, and the rates of return over various time frames. Performance reviews also include a view of the geographical allocations and the sector weightings across the entire portfolio. We discuss the present market conditions and we look at the historical trends.

Individual fund holdings are discussed and monitored for changes to managers, sustained under performance, and continuing relevance to the overall objectives. We also consider the concentration of individual securities within the overall portfolio and within each fund. We consider the allocation of the portfolio between fixed income and equities. We have a very sharp focus on income. We ensure there is enough fixed income on hand to meet the short term needs of investors and we re-balance where necessary. We offer a cash management strategy for systematically accumulating cash during the good times so that we are in a position to take advantage of opportunities when they arise. Where necessary we recommend any changes that are needed and we generally manage those changes without any additional cost to the client.

COST OF ADVICE

Our advice is simple but not easy. We make your objectives become easier with an all-inclusive service that is in limited supply within our industry. myTalisman™ is not a one size fits all solution - each client's needs are unique and individually assessed. Cost is an issue in the absence of value and we go the extra mile to make sure that the price is not an issue.

Following are explanations for the administration of the cost of advice.